Offshore Software Development Team: Eliminate Tech Talent Shortage for BFSI Sector

Provide cutting-edge technology to help financial services achieve improved security, speed, convenience, coverage, and customer experience .

.png?width=800&height=600&name=Software%20Development%20Team%20(SDT).png)

With proven software success and in-depth domain expertise, KMS can help you extend your development team capacity to efficiently accelerate the speed to market for your innovative products and services

BFSI Domain Expertise

With BFSI as a focus industry, our engineers help clients modernize legacy systems, provide innovative solutions, and improve digital user experience.

Efficient at Scale

Our engagement model allows organizations flexibility to scale their development capabilities quickly based on new business priorities and initiatives.

Proven Software Success

We have a strong track record of building and launching mission-critical applications and digital platforms for several leading companies in the industry.

Industry Best Practices

Minimize risks of development and increase quality through the technology, tools, and industry standards that are integrated into engagement processes and tool-chain.

.webp)

Our BFSI Advanced Solutions

KMS developers have deep expertise in delivering financial solutions, understanding businesses' unique requirements and demanding situations to build tailored solutions to address their challenges. Here are some banking and financial offshore software development services we offer to help you stay ahead.

eWallet Development

Our Fintech software developers help deliver feature-rich and fully secured professional eWallet apps that let banks and financial institutions handle transactions faster and more efficiently.

Trading Platform

We create and customize trading platforms that streamline processes. Tailor customized solutions, upgrade existing trading solutions, and ensure software integrates with your banking systems, ERP & and more.

Digital Banking App Development

We ensure seamless integration in the middle layers of the core banking and maintain and upgrade the systems constantly to deliver a hyper-personalized banking experience to their customers.

Insurance Software Solutions

Our experts provide advanced insurance software solutions that streamline processes such as underwriting, claim management & policy administration and focus on digital experiences for insurers.

Digital Platform Development

KMS helps companies launch digital platforms and expand their services at different stages. Our advanced services include cloud-based platform development, API externalization and middle-layer integration.

Additional Value to our Software Development Service

UX/UI Design

We develop financial banking apps that focus on user experience and market trends. With an understanding of the inner workings of the financial services industry, we bring user design to the forefront of digital transformation.

%201%20(1).png?width=60&height=60&name=testing%20(2)%201%20(1).png)

Enterprise Software Testing

We provide clients with a future-ready testing solution to shorten the delivery time by 60% while raising 64% of the test coverage and combine knowledge of CI/CD, DevOps, etc., in the testing phases.

.png?width=60&height=60&name=data-integration%201%20(2).png)

Digital Integration

By supporting companies in integrating third parties and digital channels into platforms, we connect all systems for frictionless alignment across the business, leading to optimal performance.

Diverse Group of Technology Partnerships

Our collaboration with industry leaders guarantees that our clients get premium service and support throughout the development process, which includes core areas like software testing, cloud migration, customer engagement, product analysis, and core banking systems.

.webp)

These Commitments Place Trust in Us

KMS emphasizes a commitment to high-quality software development by employing industry-standard Agile methodology and a comprehensive quality management system. To ensure optimal software delivery, we prioritize transparent communication channels and an effective testing process, utilizing our expertise in software development and testing. As evidence of this expertise, KMS has created and launched three software quality platforms: QA Symphony, Katalon, and Kobiton. Our platforms have not only contributed to the development and testing of countless software applications but also reflect our dedication to advancing the field of software quality assurance.

Our 14-year track record of providing IT services without experiencing security breaches is a testament to our commitment to protecting our customer's data. We make significant investments in our information security system to ensure it complies with ISO 27001 and SOC2 compliance and promotes a strong security culture.

With our strong focus on DevOps practices, we enable continuous delivery and deployment, allowing our customers to launch new products at a much faster pace while ensuring the robustness and scalability of those products. We also heavily invest in our people, culture, and technology to ensure that we are always up-to-date with the latest advancements in software development to meet our customer's needs.

Need a team to get your ideas off the ground? We're here to help!

By hiring an offshore software development teams, businesses can maximise efficiency and harness their skill sets to drive the company’s growth.

Cost Optimization

Eliminates the need for investment in infrastructure, recruitment, and other assorted expenses, allowing you to focus resources on core activities.

Team Scalability

Flexibly scale the team as you grow, get extended support, and fasten development. Ensure sufficient team capacity to run the project.

Innovation & Quality

Get skilful software engineers that are adaptable to tech trends quickly to focus on product innovation, helping stay ahead of the competition.

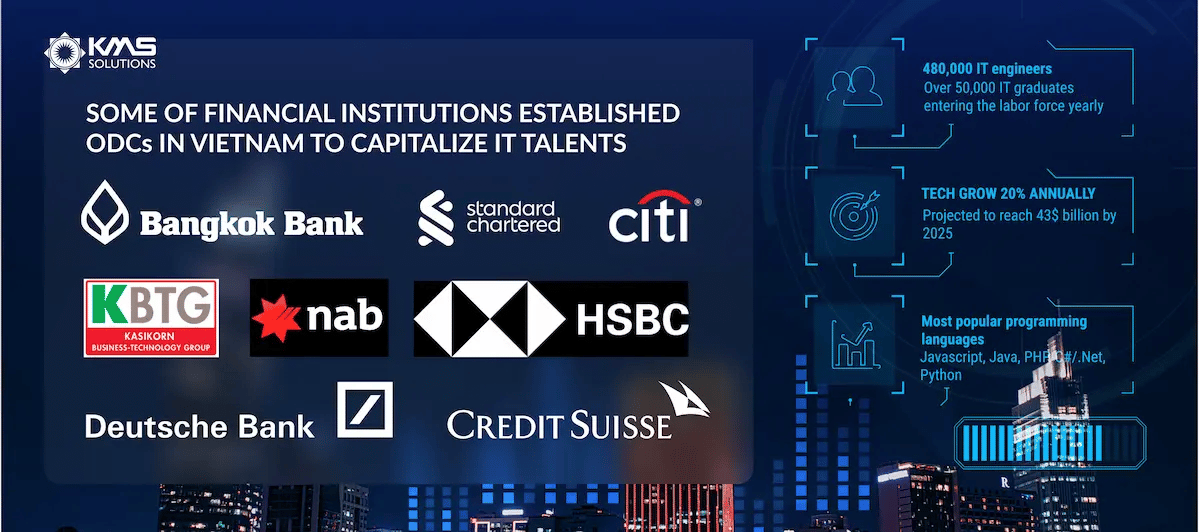

Vietnam's dynamic financial market industry has grown by 25% yearly recently. In parallel, Vietnam's tech industry is projected to grow by 20% annually.

The country is in the top 50 of the ICT Development Index and is one of Asia’s fastest-growing economies. Many Vietnamese IT & Solution Providers are now open to potential innovations.

The cost of offshore outsourcing services in Vietnam is 70% lower than that of Australian services and is much more affordable than the costs from other ASEAN countries.

We provide a well-enabled, train-the-trainer model and efficient team mix that works as an integrated part of your team that help you:

- Scale up the software development team as your business grows.

- Save your time with a painless transition process that takes only 1-3 months.

- Flexibly adopt the client’s toolchain to ensure a seamless development process or suggest a KMS standard toolchain for those who haven't established one.

We're a trusted partner for businesses' digitalisation journey

With 14+ years of experience in successfully helping businesses in the BFSI industry excel across the world and 3 ODCs operated in the Asia Pacific, KMS Solutions can leverage our global expertise and professional perspectives to be all companies’ trusted IT service providers.

We have 180+ resources supporting multiple clients in the BFSI sector. Moreover, we also helped 250+ enterprises in developing software solutions across various sectors, from banking, insurance, to financial services and many more such as ACB, DiscoveryMarket, Axi, etc., to develop financial software and build engineering teams.

KMS Solutions also won Master Entrepreneur Award at APEA 2022, ranked #9 in Clutch’s Top 100 Fastest-Growing B2B Providers, and gained Top 10 ITC companies in Vietnam 10 years in a row.

2023 Digital Banking Industry Report

Digital banking has grown in popularity in the Asia-Pacific region due to customers' growing desire to access financial services from anywhere. KMS Solutions industry reports examine the three markets in the region, which are Australia, Singapore, and Vietnam.

.webp)

How Changes in Asia Pacific’s Customer Behaviour Accelerate Digital Banking

Understand the ways customers perceive banking services, have strategies accordingly to achieve their expectations and secure a particular position in the market.

%201.webp)

Must-have Features for Banking Application

As banks build more creative features, mobile banking app is no longer a tool for remote money transaction. Get to explore various innovative features that a bank might consider for its mobile banking application, with the goal of keeping up with the Digital Banking upsurge.

Get to know more our Offshore Software Development Team Services

* By clicking on the submit entry button and submitting this form you will be indicating your consent to receiving our service consultation and marketing materials.

%202%20(1).png?width=92&height=92&name=money%20(1)%202%20(1).png)

%202.png?width=92&height=92&name=team%20(1)%202.png)

.png?width=92&height=92&name=innovation%201%20(1).png)

.webp?width=1200&length=1200&name=Group%2048095936%20(4).webp)

.webp?width=1200&length=1200&name=Group%2048095937%20(1).webp)